About Quicken

Quicken is a personal finance management tool developed by Quicken Inc. (formerly Intuit, Inc.). The software helps users manage their financial accounts, budget their expenses, and track their investments. Quicken is available in several versions for Windows and Mac, and there is also a mobile app for iOS and Android devices. In addition to tracking financial accounts and transactions, Quicken provides tools for creating and managing a budget, generating reports and charts, and even preparing and filing tax returns. The software can also be used to track investments and manage portfolio performance. Do you have any specific questions about Quicken?

Overview of Quicken

Quicken is a personal finance management tool that allows users to track their financial accounts, budget their expenses, and manage their investments. The software is available for both Windows and Mac, and there is also a mobile app for iOS and Android devices.

Tracking of financial accounts: Quicken allows users to connect to their bank, credit card, and other financial accounts and automatically import transactions. Users can categorize transactions, create a budget, and track their spending.

Investment tracking: Quicken can be used to track investments and manage portfolio performance. Users can enter information about their investments, including the purchase price, number of shares, and current value.

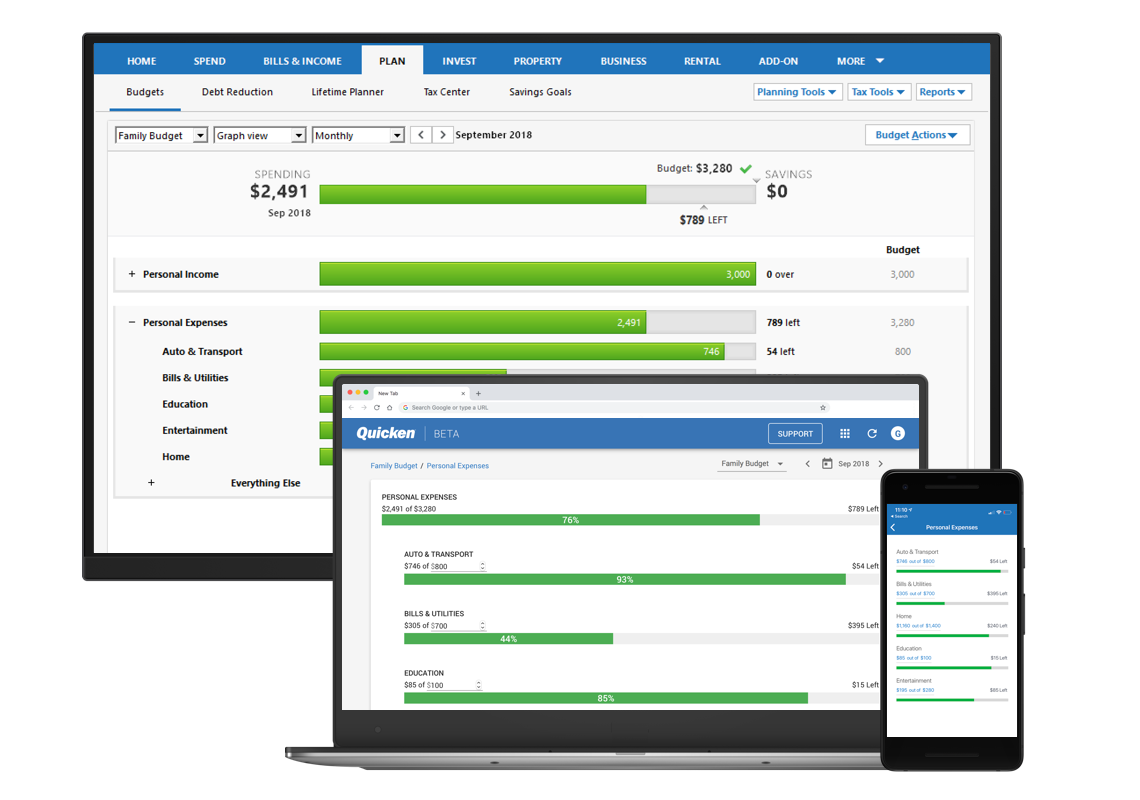

Budgeting and expense tracking: Quicken has tools for creating and managing a budget, including the ability to set up budget goals and track expenses.

Tax preparation: Quicken can be used to prepare and file tax returns, including federal and state tax returns.

Reporting and charting: Quicken provides a range of reports and charts to help users track their financial performance and identify trends.

Pros

Convenient and comprehensive: Quicken allows users to manage all of their financial accounts in one place, making it easy to track spending, create a budget, and monitor investments.

Automatic transaction importing: Quicken can automatically import transactions from connected accounts, saving users the time and effort of manually entering data.

Customization options: Quicken offers a range of customization options, including the ability to create and categorize transactions, set up budget goals, and create custom reports.

Tax preparation tools: Quicken can be used to prepare and file tax returns, which can save users time and money on tax preparation fees.

Mobile app: Quicken has a mobile app for iOS and Android devices, which allows users to access their financial data and manage their accounts on the go.

Security: Quicken uses encryption to protect users’ financial data, and the software is regularly updated to protect against security vulnerabilities.

Customer support: Quicken offers a range of customer support options, including online resources, a help center, and phone support.

Cons

Cost: Quicken is a paid software, and the cost may be a barrier for some users.

Compatibility: Quicken is only available for Windows and Mac, and it may not be compatible with all devices.

Complexity: Quicken has a lot of features and tools, which can be overwhelming for some users. It may take some time to learn how to use the software effectively.

Automatic transaction importing: While automatic transaction importing can be a convenient feature, it can also lead to errors if the imported data is incorrect. Users may need to manually correct errors or delete imported transactions.

Limited mobile app functionality: While the Quicken mobile app allows users to access their financial data and make transactions on the go, it may not have all of the same features as the desktop software.

Limited investment options: Quicken may not support all investment types or financial institutions, which can limit users’ ability to track and manage their investments.

How Much does Quicken Cost?

- Quicken Starter: $34.99/year or $3.99/month

- Quicken Deluxe: $44.99/year or $4.99/month

- Quicken Premier: $74.99/year or $7.49/month

- Quicken Home & Business: $109.99/year or $10.99/month

Is Quicken Safe to Use

- Encryption: Quicken uses encryption to protect users’ financial data while it is in transit and at rest.

- Secure servers: Quicken stores users’ financial data on secure servers that are protected by firewalls and other security measures.

- Regular updates: Quicken regularly releases updates to the software to fix bugs and address security vulnerabilities.

- Two-factor authentication: Quicken offers two-factor authentication as an optional security measure, which requires users to provide a second form of authentication (such as a code sent to their phone) in addition to their password to log in.

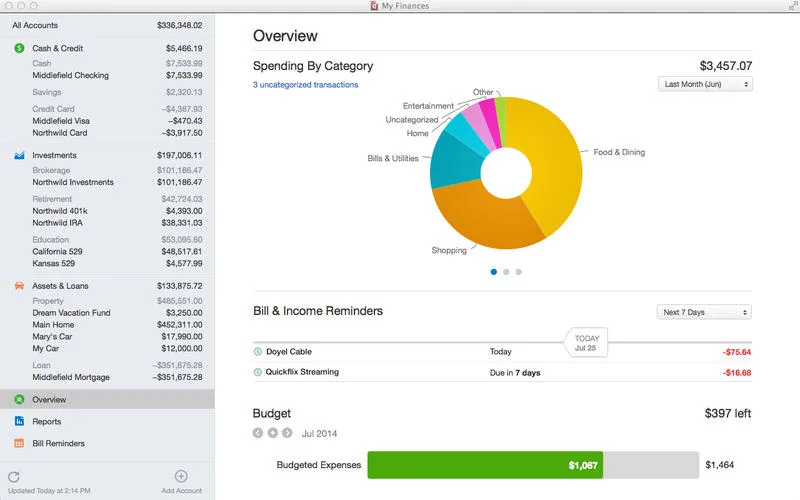

Quicken Dashboard

The Quicken dashboard is the main interface for the software, and it provides an overview of a user’s financial accounts, budget, and investments. The dashboard can be customized to display different types of information, such as a summary of account balances, a calendar of upcoming bills and payments, and charts and graphs of financial performance.

Account balances: The dashboard may display the current balances for a user’s financial accounts, such as checking and savings accounts, credit cards, and investments.

Budget overview: The dashboard may include a summary of a user’s budget, including total income, expenses, and savings.

Investment performance: The dashboard may display charts or graphs showing the performance of a user’s investments, including portfolio value and returns.

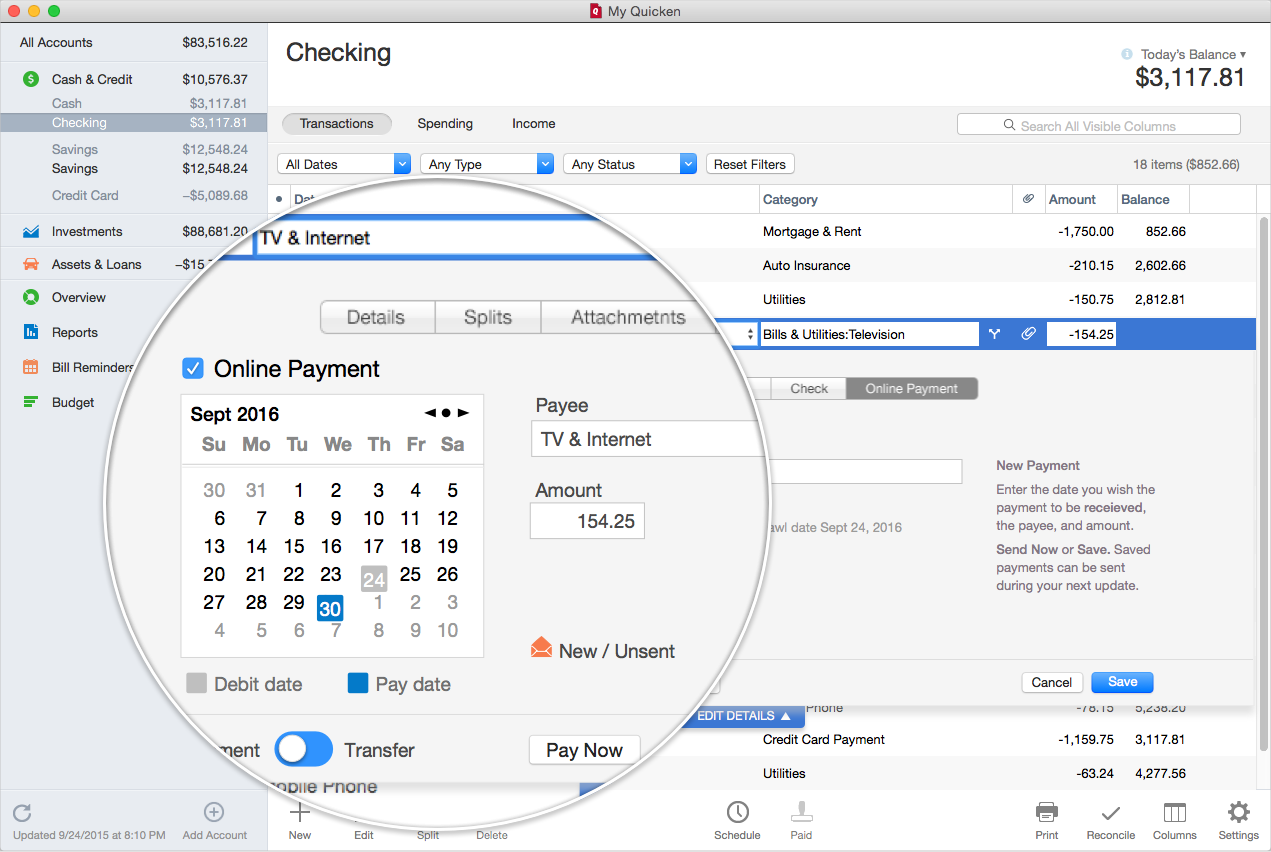

Upcoming bills and payments: The dashboard may include a calendar or list of upcoming bills and payments, along with their due dates and amounts.

Alerts and reminders: The dashboard may include alerts or reminders for important financial events, such as overdue bills or low account balances.

Tracking Income and Expenses with Quicken

Connect your financial accounts: Quicken allows users to connect to their bank, credit card, and other financial accounts and automatically import transactions. This can save time and ensure that all of your transactions are recorded in Quicken.

Categorize transactions: Quicken allows users to categorize transactions as income, expenses, or transfers. This can help users track their spending and create a budget.

Set up budget goals: Quicken has tools for creating and managing a budget, including the ability to set up budget goals for specific categories of expenses.

Track income and expenses: Quicken provides a range of reports and charts to help users track their income and expenses over time, including a profit and loss statement and a cash flow chart.

How to Get Started with Quicken

Choose a version: Quicken has several different versions available, including Quicken Starter, Quicken Deluxe, Quicken Premier, and Quicken Home & Business. Choose the version that best fits your needs.

Download and install the software: Once you’ve purchased Quicken, you can download and install the software on your computer. Follow the prompts to complete the installation process.

Set up your accounts: Quicken allows users to connect to their financial accounts and automatically import transactions. To set up your accounts, click on the “Accounts” tab and follow the prompts to add your accounts.

Categorize your transactions: Quicken allows users to categorize transactions as income, expenses, or transfers. This can help you track your spending and create a budget. To categorize transactions, click on the “Transactions” tab and use the “Category” dropdown menu to assign categories to each transaction.

Set up your budget: Quicken has tools for creating and managing a budget. To set up your budget, click on the “Budget” tab and follow the prompts to create budget goals and track your expenses.

Explore the features: Quicken has a range of features and tools available, including investment tracking, tax preparation, and reporting and charting. Take some time to explore the software and see what it can do.

Quicken Cloud

Quicken Cloud is a feature of Quicken that allows users to access their financial data and manage their accounts from any device with an internet connection. When a user saves their data to the Quicken Cloud, it is stored on Quicken’s servers and can be accessed from any device that is connected to the internet and has the Quicken software installed.

Choose a version: Quicken has several different versions available, including Quicken Starter, Quicken Deluxe, Quicken Premier, and Quicken Home & Business. Choose the version that best fits your needs.

Download and install the software: Once you’ve purchased Quicken, you can download and install the software on your computer. Follow the prompts to complete the installation process.

Set up your accounts: Quicken allows users to connect to their financial accounts and automatically import transactions. To set up your accounts, click on the “Accounts” tab and follow the prompts to add your accounts.

Categorize your transactions: Quicken allows users to categorize transactions as income, expenses, or transfers. This can help you track your spending and create a budget. To categorize transactions, click on the “Transactions” tab and use the “Category” dropdown menu to assign categories to each transaction.

Set up your budget: Quicken has tools for creating and managing a budget. To set up your budget, click on the “Budget” tab and follow the prompts to create budget goals and track your expenses.

Explore the features: Quicken has a range of features and tools available, including investment tracking, tax preparation, and reporting and charting. Take some time to explore the software and see what it can do.

Quickens Security

Quicken is personal finance software that is used to manage money, budget, and track financial transactions. It is developed and sold by Quicken Inc., a subsidiary of the financial services company Intuit. Quicken offers a range of products, including Quicken for Windows and Quicken for Mac, which are designed for use on personal computers, and Quicken Mobile, which is a mobile app for managing finances on the go.

In terms of security, Quicken uses various measures to protect user data and prevent unauthorized access to financial information. For example, Quicken uses secure servers and encryption to protect data transmitted over the internet, and it also offers features such as two-factor authentication and password protection to help secure user accounts. Additionally, Quicken has a dedicated team that works to identify and address potential security vulnerabilities in its products.

FAQ

What is Quicken?

Quicken is personal finance software that helps users manage their money, budget, and track financial transactions.

What platforms does Quicken support?

Quicken is available for Windows and Mac computers, as well as for iOS and Android mobile devices.

Can I access my Quicken data from multiple devices?

Yes, you can access your Quicken data from multiple devices using the Quicken Cloud.

Is Quicken secure?

Quicken uses various measures to protect user data and prevent unauthorized access to financial information. These measures include secure servers, encryption, two-factor authentication, and password protection.

Can I import data into Quicken from other financial software or websites?

Yes, Quicken supports data import from a variety of sources, including other financial software, banks, and investment firms.

Is there a free version of Quicken?

No, Quicken is a paid software. However, there is a free trial available that allows users to try out the software before purchasing a subscription.

How often is Quicken updated?

Quicken releases updates on a regular basis, usually several times per year. These updates can include new features, improvements to existing features, and bug fixes.